ISI Annual Report 2022

What is the ISI annual report?

The ISI Annual Report is a rich source of data on the state of the Personal Insolvency sector. Published annually, it provides insights into the numbers of protective certificates issued, insolvency arrangement approvals and contested cases. As well as this there is some commentary around the Abhaile scheme (state funded scheme to assist borrowers in mortgage arrears).

The full report is available to download by click the following link ISI Annual Report 2022.

I have also extracted some of the key findings below.

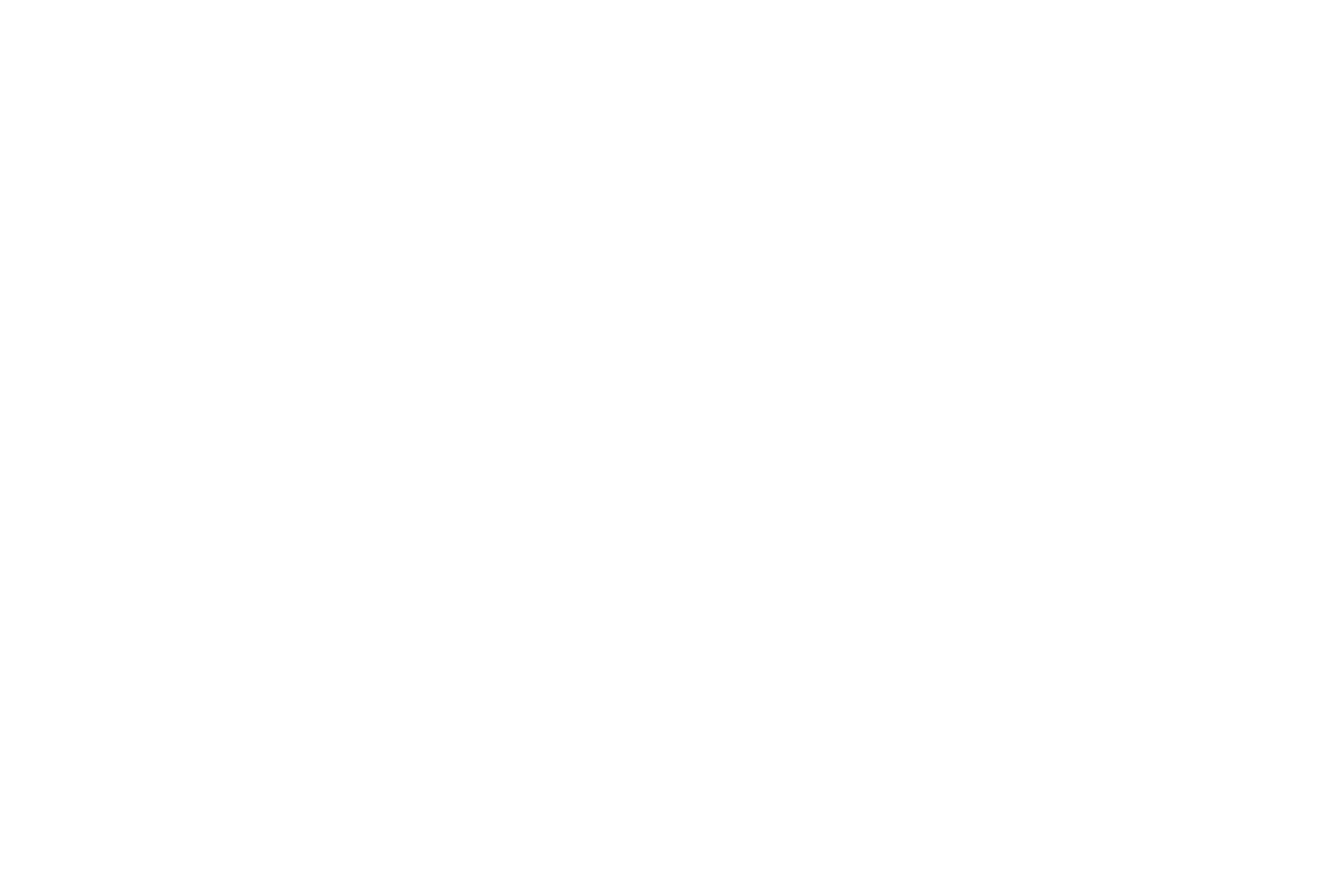

Protective Certificates Down ▼

The chart below shows a decline in PC’s since 2019. Covid 19 significantly impacted these figures and it appears to be continuing. I would also think that creditor’s being more open to putting alternative repayment arrangement’s (ARAs) in place is also impacting the figures. While this is to be welcomed, an ARA with a mortgage lender does not deal with any other debts that the debtor may have i.e. credit union, personal loans, credit cards etc.

The chart data predates the cost of living crisis and the ECB rate hikes over the past 12 months. I would suspect that there will be an increase in protective certificates in the coming year.

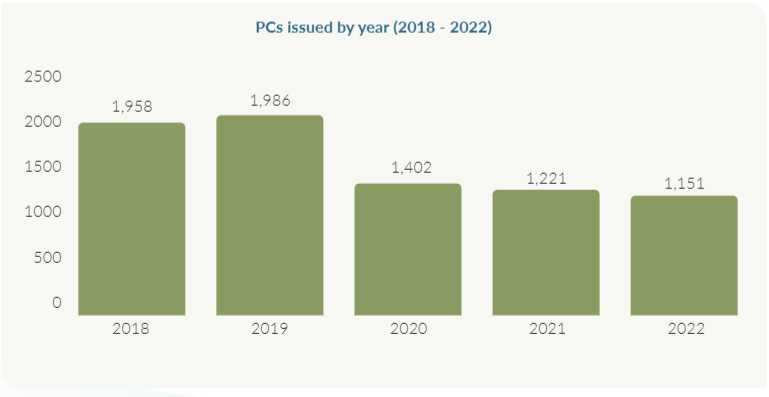

Approved Arrangements Down ▼

The chart below also shows a decline in approved arrangements since 2019. Again, Covid 19 has impacted these figures.

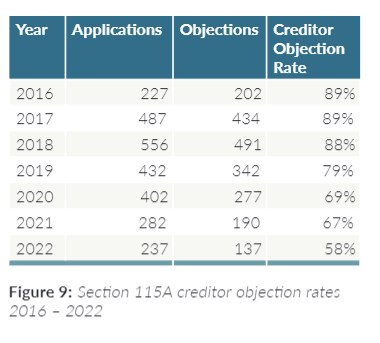

Creditor Objection Rate Down ▼

The downward trend in creditor objection rates for cases in court review (Section 115A) continues. 2016 saw an objection rate of 89%. While 2022 saw a much reduced rate of 58%. This, according to the ISI, is due to increased positive engagement between creditors and debtors around the personal insolvency process. Essentially, with full engagement between a PIP and creditors a solution more times than not can be found.

The sector has also somewhat matured in that creditors are more aware of the outcome of court reviews and tailor their decision making accordingly.

Abhaile Vouchers Issued Up ▲

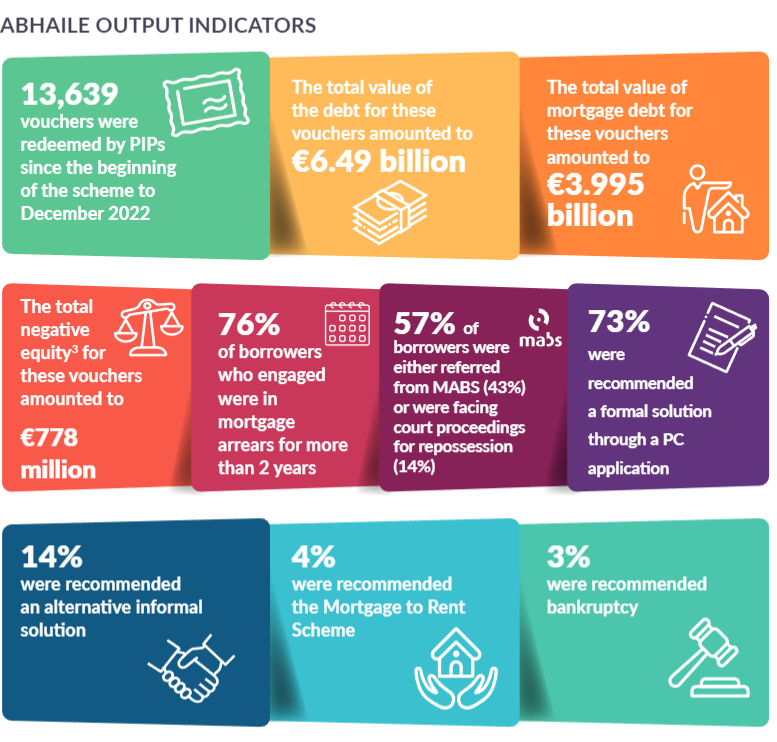

There was a slight increase in Abhaile vouchers issued on 2021 (up 1.9%). The infographic below sums up the outputs.

Conclusion

While the headline numbers in personal insolvency appear to be decreasing, the fact remains that a significant amount of people in mortgage arrears have yet to seek help with their unsustainable debts. Covid, the cost of living crisis and ECB rate hikes will contribute to an increase in people seeking personal insolvency solutions, but it may take several years for this to become fully apparent in the figures.

If you are an accountant or solicitor with a client in financial difficulty, feel free to contact us in confidence on 01 912 5190.

If you are an individual in mortgage arrears, please complete the assessment below to see if you are eligible for a free consultation.